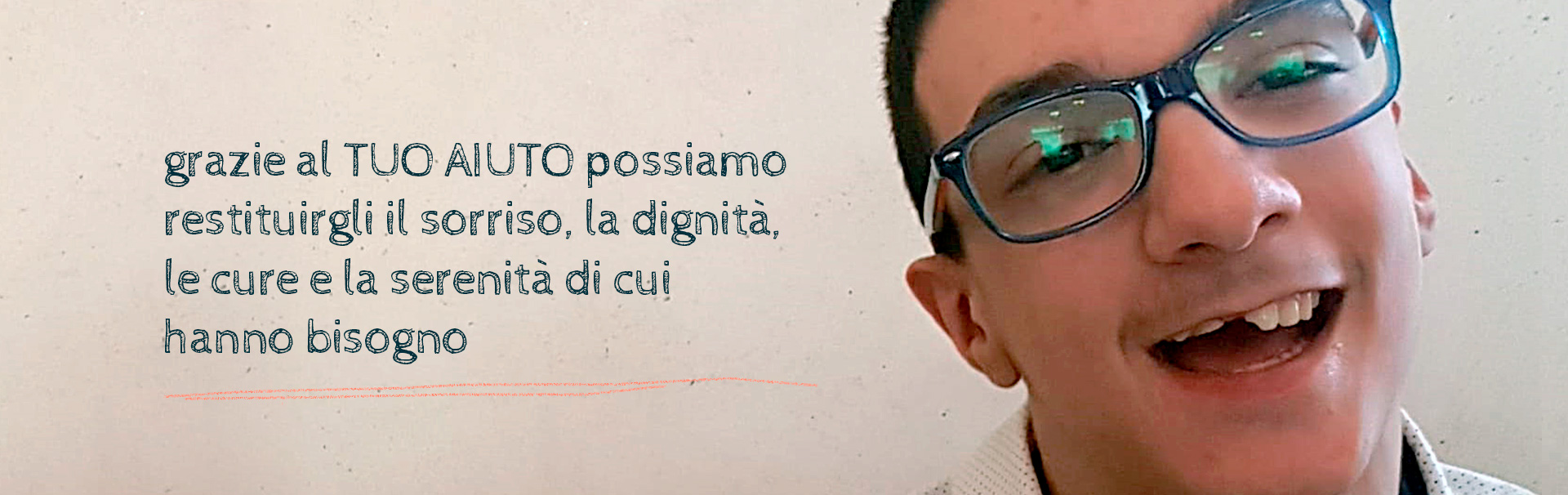

Help Us Help. By joining our projects, you can ensure greater peace of mind and a better quality of life for many little Angels.

Children with severe disabilities and high-intensity care needs, our Angels, require tangible support that we have primarily identified in qualified and free home care assistance, as it allows us to prevent them from enduring frequent and lengthy hospital stays, which result in being away from home and family for too long, with all the consequences that entail.

If You also care about the future of These Children, then choose to support the Centro Ricerche Studi, either through a single or monthly donation, because only through the combined action of Your and Our commitment can we reach more angels in need and provide them with the assistance they require.

Freely choose the amount you can donate, even if small, but the important thing is that your contribution is consistent over time to allow us to plan our interventions.

Also remember that you can donate your 5 x 1000. It costs you nothing, except the time to sign and write our Tax Code number 03965301009 in the appropriate space on your tax return.

Why Donate?

Your donation enjoys tax benefits!

Remember that the State rewards your generosity. All donations to Ce.R.S. Onlus can enjoy tax benefits; you just need to choose whether to deduct or subtract the donated amount.

N.B. Tax benefits are NOT cumulative. Cash donations do not qualify for any benefits. If you are unsure of the best solution for you, consult your trusted advisor or CAF.

Tax Benefits

Benefits on charitable donations from individuals

This category includes individuals, sole proprietors, self-employed workers, and partners of partnerships (simple partnerships, general partnerships, limited partnerships, and de facto partnerships equated by letter b) of paragraph 3 of art. 5 of the t.u.i.r.). They can alternatively opt for:

• deductibility for cash or in-kind donations, within the limit of 10% of the total declared income, and in any case up to a maximum of €70,000 annually (art. 14 paragraph 1 D.L. n. 35/2005 and subsequent amendments (L. 80/2005). The calculation of the total declared income also includes income from buildings subject to flat-rate tax.

• the 26% deduction from Irpef calculated on the maximum limit of €30,000 for savings up to €7,800 (until 2014 the limit was €2,065.83). The calculation of €30,000 also includes amounts for cash donations to populations affected by public calamities or other extraordinary events, to be indicated in the expense framework with the code "20".

In both cases, the necessary condition to access the benefit is that the payment is made through a bank or post office or by bank and circular checks. For donations made by credit card, it is sufficient to keep and present, in case of any request from the tax administration, the statement from the company managing the card.

Attention: for charitable donations to support people with severe disabilities starting from the 2016 tax year (2017 tax return), it is possible to benefit from the 20% deduction on charitable donations, donations, and other acts of gratuitousness, not exceeding €100,000 in total, in favor of trusts or special funds operating in the charity sector.

Donation Methods

We have made various donation methods available to you, both online and paper-based, to offer you the opportunity to choose according to your preferences. But to meet every type of Donor's need, we are working on activating additional tools.

Bank Transfer

Unicredit Banca di Roma – Agency 516

IBAN: IT48 S 02008 49636 000400449334.

BCC – Cooperative Credit Bank

IBAN: IT03Z0832749633000000001480

Banca Popolare del Frusinate

IBAN: IT 02 P 05297 14801 1030054402

Bank Transfer / Postal Bulletin

Postal Bulletin Donation on CC. 78849932

Donation with Poste Italiane Bank Transfer:

ABI 07601 – CAB 14800 – C.C. 78849932

Whatever method you choose for the donation, address it to:

Centro Ricerche Studi, Volunteer Association ONLUS Piazza Adriana, 4 – 00193 ROME

PayPal

It is a fast and secure method with credit card (Visa, Visa Electron, MasterCard) or prepaid card (Postepay, Vodafone Cash Card, Kalibra, etc.). Just a few clicks and without having to share your financial information.

Friend of Ce.R.S. Onlus

Make a regular donation, of any amount, and become a Friend of Ce.R.S., you will help us manage our projects more serenely. Your Monthly Contribution is indeed of fundamental importance as it allows us to:

Plan

Our interventions with greater peace of mind, being able to rely on the regularity of well-defined budgets.

Improve

The quality of services provided with the aim of achieving increasingly higher levels of specificity.

Expand

Our scope of action along with the number of services to be able to reach and help more Angels and Families in need.

Donate Your 5x1000

Allocating the 5 per thousand to Ce.R.S. is a simple and quick operation that above all costs you NOTHING! Just enter the Association's Tax Code 03965301009 in the appropriate space of your Tax Return. Supporting an Angel will make you feel good, you can put your... Signature!

How to allocate your 5X1000

The CU, 730, and UNICO tax return forms contain a space dedicated to 5X1000. Just sign in the section related to "Support for non-profit social utility organizations...", specifying the tax code of Ce.R.S. 03965301009 in the space below the signature.

Costs

Choosing to allocate the 5 per thousand does NOT cost anything, because it is NOT an additional tax, but a portion of taxes that the State waives to allocate to non-profit organizations to support their activities.

Clarification

The 5 per thousand does NOT replace the eight per thousand allocated to religious denominations. They are two distinct channels and not alternatives to each other, but both can be used to allocate part of one's taxes.

FAC-SIMILE

If you have doubts or uncertainties about where to enter our tax code, to donate your 5 X Thousand, you can view or download the facsimile files we have made available:

Model 730 | Model CUD | Model Unico